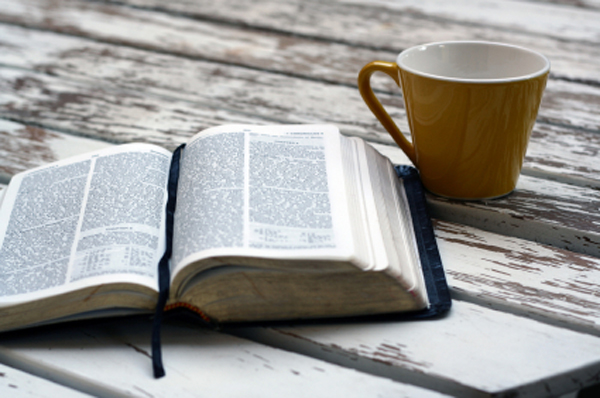

Billy Graham once said: 'A chequebook is a theology document – it shows us what we worship.' As doctors many of us are privileged to be financially secure but wealth comes with responsibility. Money holds extreme power; so what does the Bible have to say about how we should handle it?

The biblical character most famous for his wealth is Solomon. As David's successor and the constructor of the temple, many would have hailed him as infallible. But fail he did. His major downfall was taking many wives from neighbouring nations, and worshipping their deities in defiance of the law. (1) He levied burdensome taxation on his people and over-spent (perhaps as a result of taking so many wives and concubines!) so that his son Rehoboam inherited serious budget shortfalls.

The Bible offers many principles to guide our money management decisions; however it is not a financial handbook. We will look briefly at what the Bible says about earning, borrowing, giving, spending and saving.

Earning

Ecclesiastes reminds us that: 'Whoever loves money never has enough; whoever loves wealth is never satisfied with their income.' (3) We need to be careful as wealth can displace God (4) and can be a barrier to faith. (5) There are numerous examples of greed and its consequences recorded in the Bible: Gehazi, (6) Balaam, (7) Judas Iscariot, (8) and Ananias & Sapphira, (9) to name a few. However working to earn money is legitimate, (10), (11) as long as we do so fairly. (12) We are also required to ensure we pay the tax required of us. (13)

Borrowing

Most of us will have to borrow money at some point, whether to buy a house or buy into partnership as a GP. The Bible does not forbid the borrowing of money (14) but advises us to repay it as soon as possible. (15)

Giving

Instead of greed the Bible teaches us to recognise God as the great provider; we are to trust him to give us 'our daily bread' (16) but more than that we are to use the money he gives us as part of our worship. The story of the widow's mite is one of the most challenging; giving out of her poverty the widow showed her total trust in God's ability to provide for her needs. (17)

St Paul has much to teach us both as encourager and example. He encouraged the early Christians to participate in the joy of giving, so they might receive the spiritual blessings involved. (18) He worked as a tentmaker so that he need not depend on the churches' financial support. (19) His letter to the Philippians abounds with joy, and Paul rejoices that he has learnt to be content in all material situations. (20)

Giving, as with any discipline, matures through practice, diligence and prayer. It is best to make specific gifts, and regularly review the amount so as to increase it in proportion to the growth of our resources. It can be helpful to also set aside an amount each month for spontaneous giving. We are called to be generous (21) with our giving and to plan our giving in advance. (22) If all that you gave away was returned at the end of the year would it make a clear difference to you? If not maybe we need to consider whether we are giving enough.

Spending

When we view money as a precious resource that God has given we will aim to use it more efficiently. The call to be 'as clever as vipers and as innocent as doves' (23) applies well to financial management.

It is remarkable what can be saved through initiative; home-made sandwiches generate significant saving over most bought food, but can be impractical, especially if you're not a morning person!

It is important to live within our means. For some it may be wise to use money (which we have) to buy time (which many of us lack), eg by employing cleaners or decorators. Carefully consider purchases before making them but do allow yourself rest, relaxation and holiday.

Saving

We should consider repaying debt, giving and spending before we think about saving. I am sure we are all aware of the Old Testament story of Joseph, who saved Egypt from famine, through saving up grain in response to a dream God gave Pharaoh. Similarly it is important that we prepare financially for unexpected crises and future needs. However, as Christians, we need to consider how we balance giving, spending, saving and providing for our families. (24)

Our finances reveal a lot about whether Jesus is really Lord of our lives. If things are wrong with how we use our money, we need first to turn our attention to our relationship with him rather than going straight to sorting out our accounts.